Meaning Of Section 143(1)

Section 143 1 a refers to the intimation order given by the Income Tax Department of India to the assessee against a return filed for any assessment year. As per latest amendments and provisions of income tax act with the Assessment Year 2018-19 there are various new provisions related to income tax proceedings and assessment procedure being included.

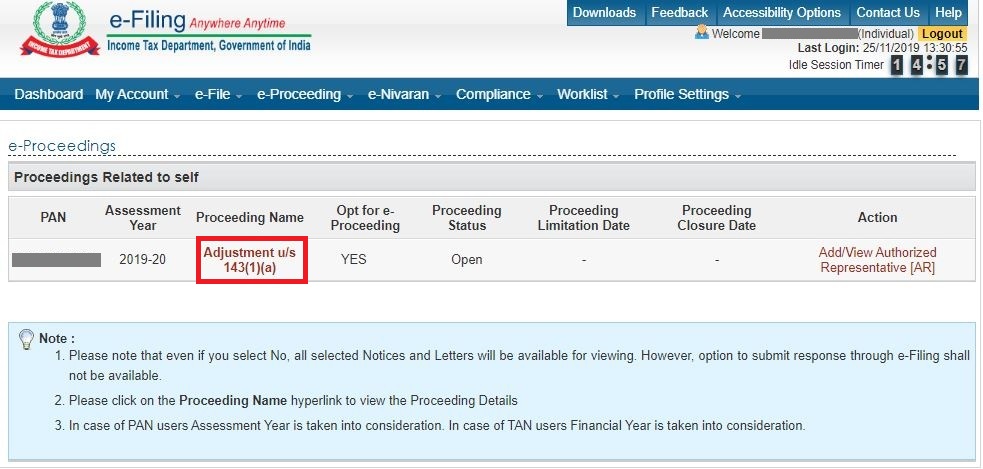

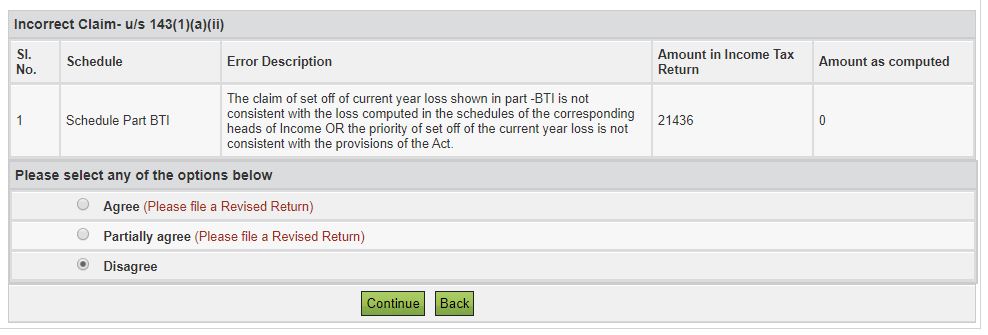

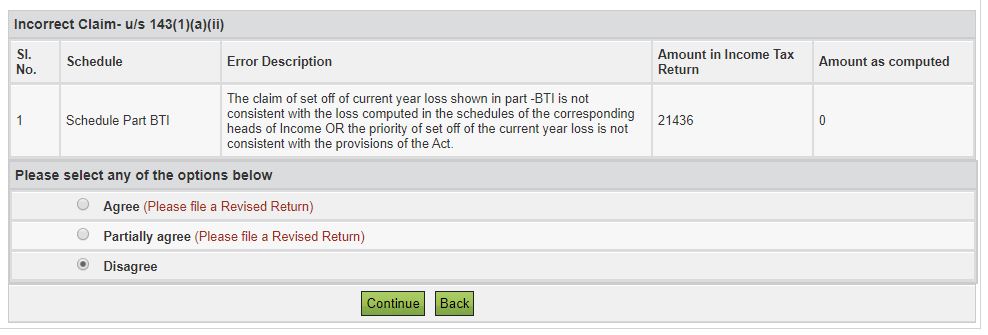

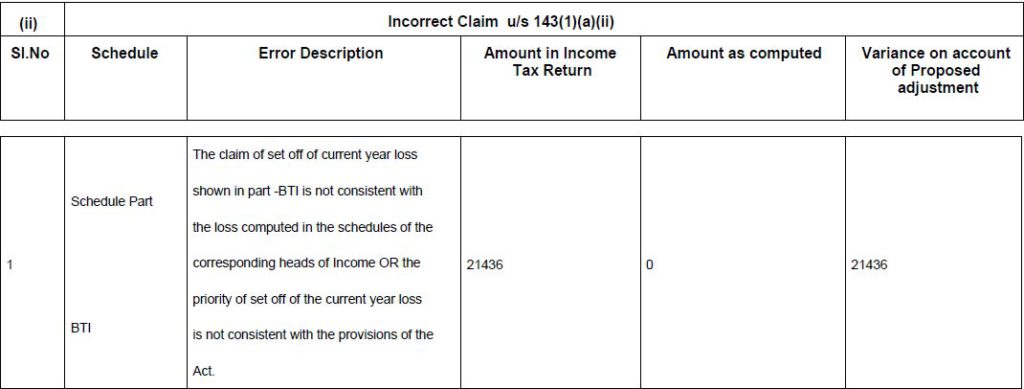

Response To Notice U S 143 1 A Ii Incorrect Claim In Itr Learn By Quicko

For a particular assessment year once a return is filed by the assessee it goes for processing to the department.

Meaning of section 143(1). This tax notice will tell you if the income computation given by you while filing ITR matches with that of the tax department. Sec 143 1 a is the Intimation order by the Income Tax Department as against the Return filed by the assessee for any Assessment Year. Basically the intimation us 143 1 contains the following information.

If the taxpayer has filed return pertaining to the financial year 2019-20 in July 2019 intimation can be sent any time till 31 March 2021. Notice under section 143 1 a is to be served within 1 year of completion of the relevant Assessment Year. A Permanent Details of assessee like name address etc.

Intimation under section 1431 is proof of processing of your income tax return. More simply Notice can be sent within one year from the end of the Financial Year in which the return is filed. It also tells the taxpayer if heshe has any interest that is payable.

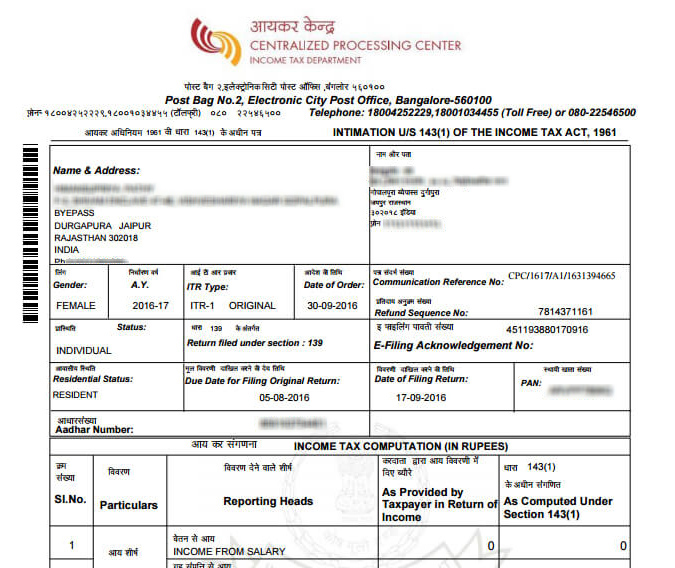

What is the timelimit for serving a notice under section 143 1 a. Once your income tax return ITR is processed the tax department is required to send you an intimation notice under section 143 1. Letter of intimation under section 143 1 of Income Tax Act.

Once the income tax department has processed your income tax return ITR it sends you an intimation notice under section 143 1 of the Income Tax Act. Section 143 1 intimation has to be sent within one year from the end of the financial year in which return is being filed. The Amended Section 143 1 of the LRA reads as follows.

In case of payment made less than the actual amount the. Intimation under sec143 1 of Income Tax Act1961 In case there is 0 in front of both as in the picture above it means that your tax return filing was perfect you neither need to pay any more tax for the year nor you would get any tax refunds. I Section 143 1 provides for computation of the total income of an assessee after making the following adjustments to the returned income.

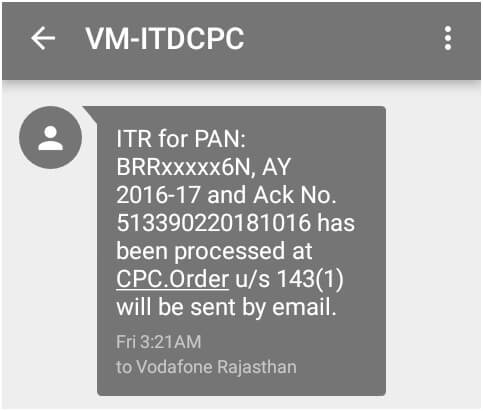

An arbitration award issued by a commissioner is final and binding and it may be enforced as if it were an order of the Labour Court in respect of which a writ has been issued. Intimation us 143 1 is a summary of the details which you have submitted to the tax department and the details which department has considered while processing your return. The system auto-generates the intimation us 143 1 and communicates to the assessee on the mobile entered while filing the income tax return The sender of the message is CPC ie.

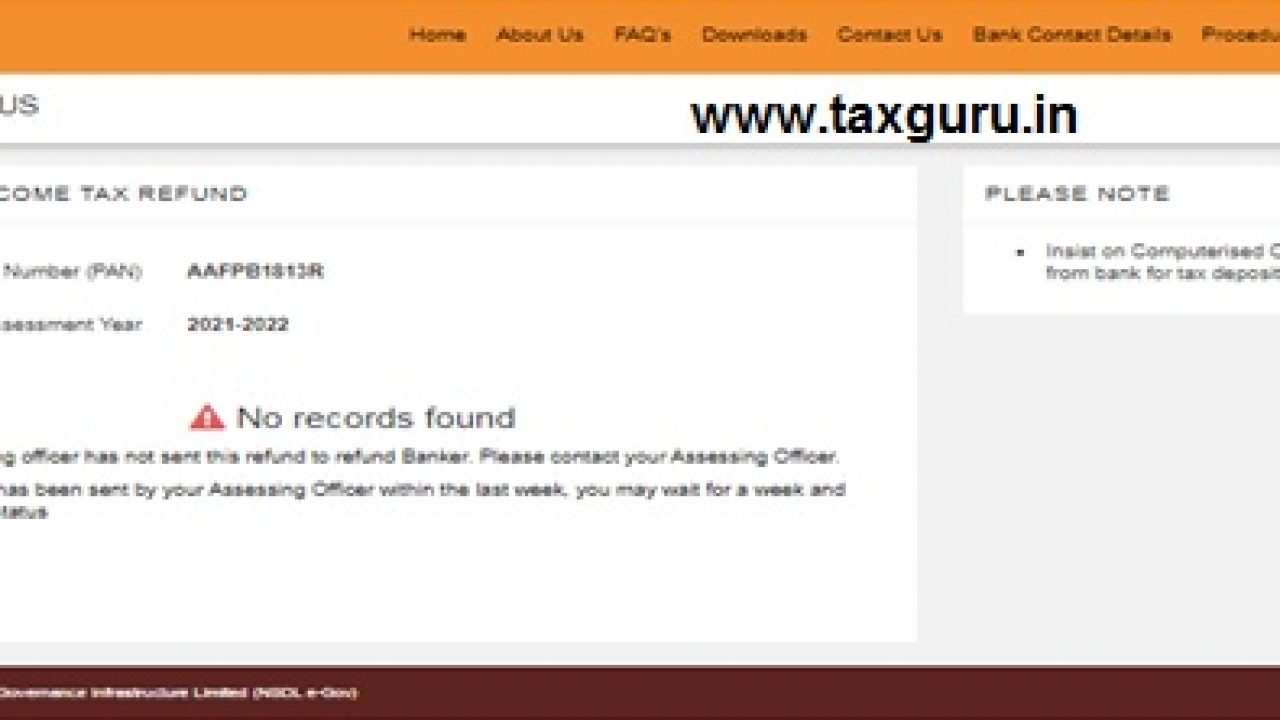

Section 143 1 of the Income Tax Act 1961 is essentially a computer generated automated message which lets the taxpayer know of any error that exists in hisher tax filing. If there is a income tax refund due to you it would be reflected in the intimation notice as well. Once your ITR is processed the income tax department sends you an intimation notice.

When does one receive Intimation under Section 143 1. According to Income Tax rules the intimation under section 143 1 has to be sent to the taxpayer within one year from the end of the financial year in which the income tax return is filed. This intimation under section 143 1 of Income Tax Rules means that you have filed your Income Tax Returns regularly and the same is acknowledged by the Department.

Tax Notices You can get and What to do about it. The assessee will receive it at their registered. Summary assessment Section 143 1 1A 1B 1C.

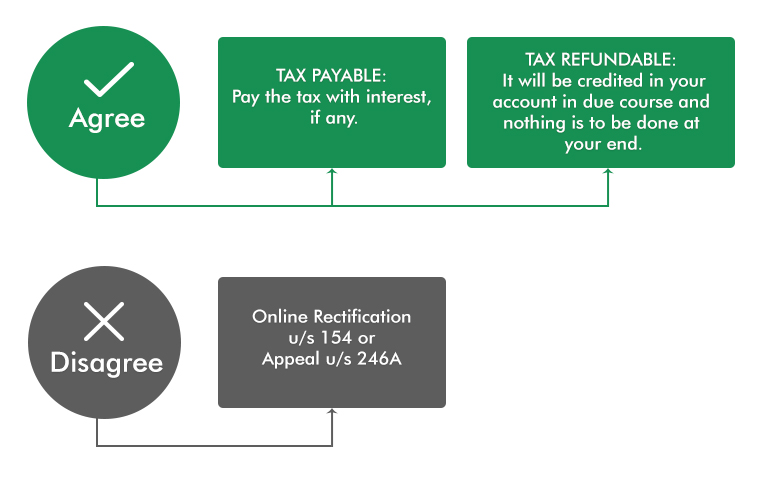

Once the income tax department processes the return it sends an intimation to the assessee under section 143 1. Ii The term an incorrect claim apparent. Intimation under Section 143 1 An assessee would receive intimation under Section 143 1 if the assessee has paid either more or less than the amount which he is actually liable to pay.

It just shows that your income tax return is free from any arithmetic error or incorrect claim apparent from any information in the return. The assessee can receive the intimation order from the Income Tax Department under section 143 1 for the following circumstances. B an incorrect claim if such incorrect claim is apparent from any information in the return.

What is Intimation us 143 1. Central Processing Centre and the senders name is VM-ITDCPC Time Limit for issue of Intimation us 143 1. What is the meaning of notice issued under Section 143 1 a of Income tax act 1961.

According to the the Sec a assessee receives such Intimation under following 3 situations- 1.

Notice U S 143 1 Intimation From Income Tax Department Tax2win

Notice U S 143 1 Intimation From Income Tax Department Tax2win

Itr Processing Communication Ay 2020 21 Section 143 1 Intimation

Response To Notice U S 143 1 A Ii Incorrect Claim In Itr Learn By Quicko

Response To Notice U S 143 1 A Ii Incorrect Claim In Itr Learn By Quicko

Notice U S 143 1 Intimation From Income Tax Department Tax2win

Itr Processing Communication Ay 2020 21 Section 143 1 Intimation

Notice U S 143 1 Intimation From Income Tax Department Tax2win

Itr Processing Communication Ay 2020 21 Section 143 1 Intimation

Post a Comment for "Meaning Of Section 143(1)"